History of 3D Printing

The Foundation Years (2000-2015)

Prologue: Standing at the Threshold (January 2000)

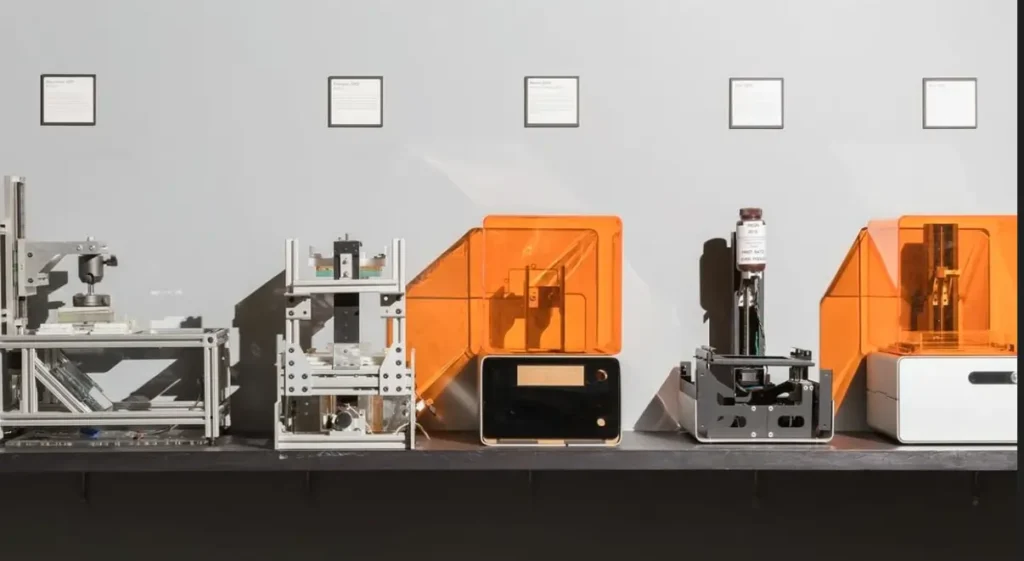

As champagne bottles emptied and Y2K fears proved unfounded, the additive manufacturing industry—still universally known as “rapid prototyping” in engineering circles—stood at an inflection point few recognized at the time. Three dominant technologies controlled the market: Stereolithography (SLA), patented by Charles Hull in 1986 and commercialized through 3D Systems; Selective Laser Sintering (SLS), developed by Carl Deckard at the University of Texas and commercialized through DTM Corporation; and Fused Deposition Modeling (FDM), invented by Scott Crump in 1988 and commercialized through Stratasys. These technologies, protected by patents scheduled to expire within the next decade, commanded premium prices—industrial SLA systems cost $200,000 to $500,000, while high-end SLS machines exceeded $700,000.

The industry served primarily aerospace and automotive companies using additive manufacturing exclusively for design verification and form-fit-function testing. Production applications remained theoretical. Material options were limited: photopolymers for SLA, nylon-based powders for SLS, and ABS plastics for FDM. The notion that households might own 3D printers, or that surgeons might implant 3D-printed organs, belonged firmly to science fiction. Yet within 15 years, both would become reality.

This first phase chronicles the transformation from industrial curiosity to mainstream phenomenon, examining the technical innovations, business consolidations, open-source movements, and cultural shifts that redefined what additive manufacturing meant and who could access it.

2000-2003: The Millennium’s Early Promise

Multi-Color Printing and Desktop Dreams (2000)

The year 2000 marked several significant technical milestones that would prove foundational for future developments. Z Corporation, founded in 1994 by researchers from MIT, released its first commercially available multi-color 3D printer. The technology, based on powder bed and inkjet printing principles licensed from MIT, represented a dramatic departure from monochrome prototypes that had dominated the industry. By depositing colored binder onto successive layers of plaster-based powder, Z Corporation’s machines could produce full-color models directly from CAD data. While the resulting parts lacked the mechanical strength of SLS-produced components or the surface finish of SLA parts, they excelled at visualization models, architectural mockups, and design communication—applications where appearance mattered more than engineering properties.

Object Geometries, an Israeli company founded in 1998, announced its first inkjet-based 3D printer utilizing a proprietary technology called PolyJet. Unlike Z Corporation’s powder-based approach, PolyJet deposited photopolymer droplets that were immediately cured by UV light, building parts layer by layer similar to inkjet document printing but in three dimensions. The technology promised smoother surface finishes than FDM and faster build times than SLA for small parts. Object’s machines could also deposit multiple materials simultaneously, enabling multi-material prints with varying mechanical properties—hard plastics adjacent to rubber-like materials within the same part. This capability, largely unexplored in 2000, would become increasingly important as the decade progressed.

Materialise, a Belgian software and service bureau founded in 1990, unveiled its Mammoth Stereolithography machine capable of building parts measuring up to 2100 x 700 x 800 millimeters. The massive system addressed a persistent limitation of additive manufacturing: build volume. While desktop and mid-sized industrial machines sufficed for most prototyping applications, large parts—automotive body panels, aerospace fuselage sections, architectural models—required either assembly from multiple smaller pieces or production via traditional methods. Materialise’s Mammoth, though expensive and limited to specialized facilities, demonstrated that additive manufacturing could scale beyond tabletop parts.

Bioprinting’s First Steps (2000-2002)

Perhaps the most audacious development of the millennium’s first years occurred in biomedical engineering laboratories exploring whether living cells could survive the 3D printing process. In 2000, researchers at the Wake Forest Institute for Regenerative Medicine, led by Dr. Anthony Atala, successfully 3D-printed a miniature kidney structure incorporating living cells. The structure, approximately one-third the size of a human kidney, contained the anatomical features of the organ: filtration tubules, vascular channels, and collecting ducts. However, it lacked functionality—the cells survived the printing process but didn’t perform the complex biochemical functions of actual kidney tissue.

This early bioprinting work, conducted using modified inkjet print heads to deposit cells suspended in hydrogel materials, established fundamental principles that would guide subsequent research. The team discovered that cell viability depended critically on printing parameters: nozzle diameter, pressure, temperature, and material viscosity all affected what percentage of cells survived deposition. They also recognized that creating functional organs required not just correct geometry but also appropriate cellular organization, vascular networks for nutrient delivery, and integration with the recipient’s immune system—challenges that would occupy researchers for decades.

By 2002, the same Wake Forest team had refined their techniques sufficiently to create more complex kidney structures with improved cellular organization. While still non-functional and unsuitable for transplantation, these experiments proved that additive manufacturing principles could be applied to biological materials. The media coverage, though limited to scientific publications and occasional mainstream articles, planted the idea that 3D printing might someday address the chronic shortage of transplantable organs.

Desktop Arrives and Metals Emerge (2001-2003)

In 2001, Israeli company Solidimension introduced what they marketed as “the world’s first desktop 3D printer,” though the definition of “desktop” remained contentious. Measuring approximately 600 x 600 x 400 millimeters and priced at $20,000—a fraction of industrial system costs but still prohibitively expensive for individuals—the printer used UV-curable resins similar to SLA technology but in a more compact package. While few individuals purchased Solidimension printers, design studios, dental laboratories, and jewelry manufacturers adopted them for applications where desktop convenience and reasonable part quality outweighed the limitations of small build volume and restricted material options.

The introduction of metal-capable additive manufacturing systems represented perhaps the most significant technical advancement of the early 2000s. In 2003, Swedish company Arcam released its first Electron Beam Melting (EBM) system, using a focused electron beam rather than a laser to melt metal powder in a vacuum chamber. Unlike laser-based systems that scanned point-by-point, EBM could preheat the entire powder bed and selectively melt specific regions, resulting in parts with reduced residual stresses and better properties for certain materials, particularly titanium alloys. Arcam initially targeted medical implant manufacturers, recognizing that orthopedic companies would pay premium prices for patient-specific hip stems and acetabular cups that conventional machining couldn’t economically produce.

That same year, German manufacturer EOS GmbH released its first laser-sintering system specifically designed for metal powders. The EOSINT M 250 Xtended used a 200-watt fiber laser to selectively melt metal powder—initially focusing on stainless steel and tool steel alloys—layer by layer. While EOS had pioneered polymer SLS systems in the 1990s, metal systems presented substantially greater technical challenges: higher melting temperatures, reactive materials requiring inert atmosphere processing, thermal stresses causing part warping, and powder handling safety concerns. EOS’s entry validated metal additive manufacturing as commercially viable, though applications remained limited to high-value aerospace and medical components where conventional manufacturing proved difficult or impossible.

Z Corporation released its first commercially available multi-color 3D printer in 2003, the Spectrum Z510, building on their earlier powder-and-binder technology. The system could reproduce full-color CAD models with CMYK color capabilities, finding immediate adoption in architecture firms, product design studios, and medical illustration applications where color-coding internal structures aided understanding.

Consolidation Begins: 3D Systems Acquires DTM (2001)

The additive manufacturing industry’s first major consolidation occurred in April 2001 when 3D Systems, dominant in SLA technology, acquired DTM Corporation for $45 million in cash. DTM, founded in 1987 by Carl Deckard and Paul McClure to commercialize Deckard’s SLS patents, had established itself as the leading manufacturer of powder-based laser sintering systems for both polymer and metal materials. The acquisition gave 3D Systems control over two of the three dominant additive manufacturing technologies—SLA and SLS—creating a company with annual revenues exceeding $150 million and market dominance that would persist through much of the decade.

For customers, the acquisition presented mixed outcomes. 3D Systems gained access to DTM’s substantial patent portfolio and technical expertise, accelerating material development and system refinement. However, some longtime DTM customers worried about reduced competition leading to higher prices and slower innovation. These concerns proved partially justified as 3D Systems focused primarily on high-margin industrial systems rather than pursuing lower-cost alternatives that might cannibalize existing product lines.

2004-2009: The RepRap Revolution and Patent Expiration

RepRap: Open Source Self-Replication (2004-2008)

On February 4, 2004, Dr. Adrian Bowyer, a senior lecturer in mechanical engineering at the University of Bath, UK, announced a project that would ultimately transform the 3D printing landscape more profoundly than any corporate initiative. The RepRap Project—short for “Replicating Rapid Prototyper”—aimed to create an open-source, self-replicating 3D printer that could manufacture most of its own components. Bowyer’s philosophy was elegantly simple: if 3D printers could print the plastic parts needed to build more 3D printers, the technology could spread exponentially at minimal cost, democratizing manufacturing access globally.

The concept faced immediate skepticism from the established industry. How could a self-built printer achieve the precision of commercial systems costing tens or hundreds of thousands of dollars? Could hobbyists without engineering degrees successfully build and operate such machines? Would self-replicated printers produce offspring with sufficient quality to build further generations, or would degradation limit reproduction? Bowyer and his growing team of collaborators, working primarily through online forums and sharing designs via the internet, set out to answer these questions.

The first functional RepRap prototype, completed in 2006 and named “Darwin” after the biologist who proposed evolutionary theory, successfully printed approximately 50% of its own plastic parts. The remaining components—motors, electronics, threaded rods, belts—required conventional purchase, but the ability to print major structural elements dramatically reduced the cost of building a second machine. Darwin used FDM principles, extruding molten plastic through a heated nozzle while moving in three axes under computer control. The build volume measured 200 x 200 x 140 millimeters, print resolution varied between 0.2 and 0.4 millimeters layer height, and build speeds were glacial by industrial standards—a small part might require several hours.

Yet Darwin’s technical capabilities mattered less than its philosophical implications. By releasing all design files, firmware, and assembly instructions under the GNU General Public License, the RepRap team ensured anyone could build, modify, and improve the design without restriction. Within months, hundreds of builders worldwide had constructed their own Darwin printers, many immediately proposing improvements. The RepRap community, communicating primarily through forums and an IRC channel, developed a collaborative engineering culture that accelerated innovation far beyond what any single company could achieve.

Successive RepRap generations—Mendel (2009), Prusa Mendel (2010), and numerous derivative designs—improved upon Darwin’s limitations. Build volumes increased, print quality improved, reliability strengthened, and ease of assembly enhanced. Critically, the community developed Fused Filament Fabrication (FFF) as an open-source alternative terminology to Stratasys’s trademarked “Fused Deposition Modeling,” enabling discussion and development without infringing intellectual property.

The Patent Expiration Catalyst (2009)

The single most transformative event in 3D printing history occurred not with any technical innovation but with the expiration of Stratasys’s foundational FDM patent (US Patent 5,121,329, “Apparatus and Method for Creating Three-Dimensional Objects”) in 2009. Scott Crump had filed the patent in 1989; it issued in 1992, providing Stratasys with 20 years of exclusive control over the FDM process. During that period, Stratasys maintained pricing that reflected its monopoly position—professional FDM systems cost $30,000 to $100,000, with entry-level models still exceeding $15,000.

Patent expiration removed the legal barriers preventing others from manufacturing FDM-based 3D printers. Combined with RepRap’s proof that functional printers could be built with relatively simple components, entrepreneurs worldwide recognized a market opportunity: produce lower-cost FDM printers for small businesses, educational institutions, and eventually consumers. The timing proved perfect—RepRap had created a community of enthusiasts familiar with 3D printing principles and hungry for better machines, while mainstream media coverage (still limited but growing) had introduced the concept to potential customers beyond engineering professionals.

Within months of patent expiration, dozens of companies announced desktop 3D printers. Some, like MakerBot Industries (founded January 2009 by Bre Pettis, Adam Mayer, and Zach Smith), emerged directly from the RepRap community and initially maintained open-source principles. Others, particularly manufacturers in China, entered the market with closed-source designs but dramatically lower prices. The competitive dynamics triggered a price collapse: by 2010, functional desktop 3D printers cost $1,000 to $3,000; by 2012, sub-$500 machines appeared; by 2014, some models sold for under $300.

This democratization—driven by patent expiration and open-source development—fundamentally altered the 3D printing narrative. What had been an industrial prototyping technology accessible only to well-funded organizations became a maker movement phenomenon, educational tool, and hobbyist pursuit. The implications extended beyond mere market expansion; they challenged traditional manufacturing paradigms about who could produce physical objects and how production might be organized.

Bioprinting Advances: Vessels and Organs (2008-2009)

While desktop FDM printers captured media attention, bioprinting research progressed steadily. In 2008, engineers created the first fully functional 3D-printed prosthetic limb incorporating all components—joints, socket, connecting elements—printed “as-is” without requiring subsequent assembly. The prosthetic, though not suitable for widespread clinical use due to material limitations and regulatory uncertainties, demonstrated additive manufacturing’s potential for producing complex, customized medical devices that traditional manufacturing would struggle to replicate economically.

In November 2009, Organovo, a bioprinting company founded by Gabor Forgacs and Keith Murphy, successfully 3D-printed the first functional blood vessel using living cells. The vessel, measuring approximately two millimeters in diameter and several centimeters long, maintained cell viability and exhibited appropriate biological properties for several weeks under laboratory conditions. This achievement addressed one of bioprinting’s most fundamental challenges: creating vascular networks capable of delivering nutrients to cells within thick tissue structures. Without vascularization, 3D-printed tissues thicker than approximately 200 micrometers—the diffusion limit for oxygen and nutrients—would experience cell death in their interiors.

Organovo’s blood vessel employed a novel bioprinting approach: rather than directly depositing cells in final positions, the company printed cellular spheroids—tiny balls of aggregated cells—that fused together post-printing, similar to how liquid droplets merge. This technique, called “tissue sphere printing,” produced structures with more natural cellular organization than conventional bioprinting methods that treated cells as merely another printable material.

Material Science Progress (2005-2009)

Material development, often overshadowed by hardware innovations, quietly expanded additive manufacturing’s application envelope. In 2005, Z Corporation released the Spectrum Z510, positioning it as the first high-definition color 3D printer capable of producing models with fine detail and accurate color reproduction for architectural visualization, medical modeling, and design verification. The system’s plaster-based powder, infiltrated with colored binder, produced parts that could be post-processed with infiltration techniques to improve strength and durability, though they remained fundamentally brittle compared to engineering plastics.

Stratasys, defending its position in professional FDM systems, released bio-compatible materials in 2008 specifically formulated for medical device prototyping and eventually sterilizable production parts. The materials, certified for biocompatibility according to ISO 10993 standards, opened pathways for using FDM not just for prototyping but for creating custom surgical guides, anatomical models for surgical planning, and eventually patient-specific implants.

For SLS systems, material suppliers introduced numerous specialty powders: glass-filled nylons for increased stiffness, flame-retardant formulations for aerospace applications, aluminum-filled polymers for metal-like appearance, and flexible elastomeric materials for rubber-like parts. Each material required extensive characterization—determining optimal laser power, scan speed, powder bed temperature, and other process parameters—representing substantial development investment that only the largest suppliers could justify economically.

Metal additive manufacturing materials evolved most dramatically. Initial systems worked primarily with stainless steel and tool steel alloys. By 2009, suppliers offered titanium Ti6Al4V for aerospace and medical applications, Inconel 718 for high-temperature turbine components, aluminum alloys for lightweight structures, and cobalt-chrome for dental prosthetics. However, material costs remained prohibitive for most applications: titanium powder cost $200-300 per kilogram, while specialized alloys like Inconel exceeded $400 per kilogram.

The First 3D-Printed Car and Large-Scale Applications (2007-2010)

In 2007, Jim Kor of Kor Ecologic began developing Urbee, a three-wheeled, two-passenger hybrid vehicle designed from the ground up for efficient urban transportation. The project’s revolutionary aspect wasn’t the hybrid drivetrain—that technology had existed for years—but rather Kor’s decision to produce the entire exterior body using additive manufacturing. Working with Stratasys on oversized FDM systems, Kor’s team printed each body panel: hood, roof, doors, fenders, and windscreen frame. The printing process consumed approximately 2,500 hours of machine time for all components.

Urbee made its public debut in 2010, generating substantial media coverage as “the world’s first 3D-printed car,” though this description oversimplified reality. The chassis, suspension, drivetrain, wheels, electronics, and interior components were all conventionally manufactured; only the exterior body panels were 3D-printed. Nevertheless, Urbee demonstrated several compelling advantages of additive manufacturing for automotive applications: complete design freedom enabling optimized aerodynamics (Urbee achieved remarkable fuel efficiency), rapid iteration during development, and elimination of expensive tooling that typically makes low-volume vehicle production economically impossible.

The automotive industry took notice, though production applications remained distant. Ford, BMW, and other major manufacturers had used additive manufacturing for prototyping since the 1990s, but Urbee suggested possibilities for low-volume specialty vehicles, customized components, and potentially spare parts on demand rather than maintaining massive inventories of every conceivable replacement part.

Dr. Behrokh Khoshnevis at the University of Southern California continued refining Contour Crafting, his concrete 3D printing technology for building-scale construction. By 2009, Khoshnevis had demonstrated the ability to print concrete walls accurately using a large-scale gantry system that extruded concrete through a computerized nozzle system. His vision: printing entire houses in hours or days, dramatically reducing construction costs and enabling rapid shelter provision following natural disasters or in developing regions. While technical challenges—printing roofs, integrating utilities, meeting building codes—prevented immediate practical application, Contour Crafting established construction as a potential additive manufacturing domain.

Service Bureaus and Democratization (2008-2010)

Recognizing that most individuals and small businesses wouldn’t purchase 3D printers even at democratized prices, several companies launched online 3D printing services enabling customers to upload CAD files and receive printed parts via mail. Shapeways, founded in 2007 in the Netherlands as a Philips lifestyle incubator spinoff, opened to the public in 2008 offering printing in multiple materials including plastics, metals, and ceramics. The service targeted designers, artists, and entrepreneurs who wanted to produce custom objects without capital investment in machinery.

Sculpteo (France) and i.materialise (Belgium, operated by Materialise) launched similar services in 2009, each offering slightly different material options and pricing structures. These service bureaus transformed 3D printing from capital equipment requiring technical expertise into a utility accessible to anyone with CAD skills and internet access. The implications extended beyond convenience; by aggregating demand from numerous customers, service bureaus could invest in high-end industrial equipment—metal printers, large-format systems, specialized materials—that individuals couldn’t justify economically.

The service bureau model also enabled production-scale manufacturing for low-volume applications. A product designer could sell items online without maintaining inventory, ordering parts from service bureaus only when customers placed orders. This print-on-demand approach eliminated warehousing costs, reduced capital requirements, and enabled mass customization where each product could be uniquely tailored to customer specifications.

2010-2012: Mainstream Recognition and Corporate Consolidation

Media Breakthrough and Cultural Penetration (2010-2011)

The years 2010-2011 marked additive manufacturing’s transition from engineering specialty to mainstream cultural phenomenon. Media coverage increased exponentially, though accuracy varied wildly. Enthusiastic articles proclaimed 3D printers would soon manufacture everything from food to organs to entire buildings, while skeptics dismissed the technology as expensive and limited compared to conventional manufacturing. Both perspectives oversimplified reality, but the volume of coverage itself signaled that 3D printing had captured popular imagination in ways the industry had never previously achieved.

Several factors drove this media attention. First, desktop 3D printer prices had fallen sufficiently that technology journalists could purchase and experiment with the machines themselves, generating firsthand accounts rather than relying solely on manufacturer press releases. Second, crowdfunding platforms like Kickstarter and Indiegogo enabled 3D printer startups to generate both funding and publicity simultaneously, with successful campaigns often attracting media coverage. Third, the objects people printed—from replacement parts for household items to custom jewelry to Star Trek memorabilia—provided compelling visual and narrative content for articles and television segments.

MakerBot emerged as the media face of desktop 3D printing, helped by charismatic co-founder Bre Pettis who proved adept at publicity and storytelling. The company’s Replicator series, introduced in 2012, refined the RepRap-inspired design with improved reliability, larger build volume, and polished aesthetics that appealed to users wanting functional machines rather than hobbyist projects. MakerBot also operated Thingiverse, an online repository where users shared 3D printable designs freely, creating a virtuous cycle: more designs made 3D printers more useful, increasing sales and attracting more designers to the platform.

However, MakerBot’s relationship with the open-source community grew strained as the company received venture capital investment and pursued growth strategies. While initial MakerBot printers were open-source hardware with all design files freely available, later models became increasingly closed-source. This shift, culminating in 2012 when MakerBot stopped releasing design files, generated controversy within the maker community. Critics accused MakerBot of building its business on open-source foundations then abandoning the principles that enabled its success. Supporters argued that commercial viability required protecting intellectual property and that MakerBot’s success benefited the overall 3D printing ecosystem by attracting investment and mainstream attention.

Material Innovation: Carbon Fiber and High-Performance Polymers (2011)

CRP Technology, an Italian manufacturer specializing in rapid prototyping services, introduced Windform XT 2.0 in 2011, a carbon fiber-reinforced material for SLS printing. The material combined nylon polymer with carbon fiber reinforcement, producing parts with exceptional stiffness-to-weight ratios suitable for functional prototypes and even low-volume production components. CRP had been experimenting with composite materials since 2007, recognizing that the primary limitation preventing additive manufacturing from production applications was often material properties rather than process capabilities.

Carbon fiber reinforcement addressed SLS nylon’s primary weakness: while nylon offered good toughness and chemical resistance, it lacked the stiffness required for structural components. By incorporating short carbon fibers—typically 100-200 microns long—throughout the polymer matrix, Windform XT achieved stiffness approaching aluminum at a fraction of the weight. The material found immediate adoption in motorsports applications where teams needed lightweight, stiff components in small quantities and could justify premium material costs.

3D Systems introduced Accura PEAK in 2010, a photopolymer for SLA printing designed to mimic polycarbonate properties. Traditional SLA materials were brittle and susceptible to moisture absorption, limiting their use to non-functional prototypes. Accura PEAK offered improved toughness and dimensional stability, expanding SLA’s application range to functional testing and eventually some production applications. Later that year, 3D Systems released Accura CeraMAX, a rigid, ceramic-filled photopolymer enabling parts that could withstand high temperatures and harsh chemical environments.

The material innovation race reflected a fundamental industry evolution: as hardware capabilities improved and became increasingly commoditized, differentiation shifted toward materials. Companies with proprietary materials that enabled unique applications could maintain premium pricing and customer loyalty even as basic hardware prices fell.

The Medical Revolution: DMLS Dental Plants and Custom Implants (2010)

The intersection of metal additive manufacturing and medical applications reached commercial viability in 2010 when Renishaw plc, a UK-based engineering company, opened a dental manufacturing facility producing cobalt-chromium prosthetic frameworks using Direct Metal Laser Sintering (DMLS). The facility addressed a specific dental industry pain point: traditional cast metal frameworks required extensive manual labor, multiple patient appointments, and long lead times. DMLS could produce custom frameworks directly from digital scans of patients’ mouths, dramatically reducing production time and improving fit precision.

The economic case for dental DMLS was compelling. A traditional cast framework might require 10-15 hours of skilled dental technician time for wax-up, investing, casting, and finishing, with material costs around $50-100 and labor costs of $300-500 depending on complexity. DMLS production consumed approximately 2-3 hours of machine time (though multiple frameworks could be built simultaneously), material costs of $100-150, and minimal finishing labor, with total costs comparable to or lower than casting while offering superior consistency and faster turnaround.

More importantly, DMLS frameworks fit better because they were produced directly from digital scans without the dimensional changes inherent in traditional wax-up and casting processes. Better fit meant fewer remakes, higher patient satisfaction, and reduced chair time for adjustments. By 2012, multiple dental laboratories worldwide had installed DMLS systems, collectively producing tens of thousands of frameworks annually.

The success of dental DMLS validated a broader principle: additive manufacturing achieves economic viability not by competing directly with mass production methods on per-unit cost, but by providing value through customization, reduced lead time, and elimination of tooling investment that makes traditional processes uneconomical for low volumes.

Corporate Consolidation: Stratasys-Objet Merger (2012)

On April 16, 2012, Stratasys and Objet Geometries announced a merger creating a combined company worth approximately $3 billion with estimated annual revenues exceeding $300 million. The deal, structured as an all-stock transaction with Stratasys holding 55% and former Objet shareholders 45%, united the leader in FDM technology with the leader in PolyJet technology, creating a combined company with complementary technology portfolios and minimal direct competition.

The strategic rationale was compelling. Stratasys dominated FDM, particularly for production-grade systems in aerospace and automotive applications, but FDM’s visible layer lines and requirement for support structures limited applications where surface finish mattered. Objet’s PolyJet produced smoother surfaces and supported fine details but cost more per part and offered fewer engineering materials. Together, they could offer customers appropriate technology for each application: FDM for durable functional parts, PolyJet for high-detail prototypes and multi-material assemblies.

The merger also reflected defensive positioning. While Stratasys and Objet controlled the high end of desktop and professional systems, Chinese manufacturers were flooding the entry-level market with $500-2,000 FDM printers. By combining resources, the merged entity could invest more in material development, software, and service capabilities that justified premium pricing while maintaining market share against low-cost competitors.

For customers, the merger presented both opportunities and concerns. The combined company’s broader technology portfolio meant one-stop shopping for multiple additive manufacturing needs. However, reduced competition between two major players raised worries about price increases and slower innovation. Industry observers noted that 3D Systems’ 2001 acquisition of DTM had given that company control over both SLA and SLS technologies with mixed results for customers.

Obama’s State of the Union: 3D Printing Goes Mainstream (2013)

On February 12, 2013, President Barack Obama devoted a portion of his State of the Union address to manufacturing renaissance and specifically mentioned 3D printing: “A once-shuttered warehouse is now a state-of-the-art lab where new workers are mastering the 3D printing that has the potential to revolutionize the way we make almost everything.”

While Obama’s remarks lasted only seconds and contained the typical hyperbole of political speeches, their impact on 3D printing public awareness proved substantial. Mainstream news organizations, many of which had previously covered 3D printing sporadically if at all, produced feature articles and television segments. Google search volume for “3D printing” spiked immediately following the speech and remained elevated for months. The technology, previously known primarily within engineering and maker communities, entered popular consciousness.

The heightened visibility attracted both investors and entrepreneurs. Venture capital funding for 3D printing startups increased dramatically in 2013-2014, enabling companies to accelerate development but also creating pressure for rapid growth and returns that would later prove problematic for some ventures. Public markets responded as well: 3D Systems’ stock price increased from approximately $25 in early 2013 to over $90 by December 2013 before eventually correcting; Stratasys experienced similar appreciation.

However, the media frenzy also generated unrealistic expectations. Articles breathlessly predicted that within a few years, households would print their own dishes, furniture, and clothing, eliminating retail stores. Such scenarios ignored fundamental economics—mass production remains far cheaper than individual printing for most items—but the narrative took hold. When reality inevitably disappointed overhyped expectations, a backlash would follow.

2013-2015: Hype Cycle Peak, Backlash, and Industrial Maturation

MakerBot’s Stratasys Acquisition and Open Source Tensions (2013)

On June 19, 2013, less than four months after Obama’s State of the Union address, Stratasys announced its acquisition of MakerBot Industries in a deal valued at $604 million, with $403 million paid immediately in stock. The acquisition shocked many in the 3D printing community, particularly given MakerBot’s origins in the open-source RepRap movement and its previous positioning as a democratizing alternative to expensive industrial systems.

For Stratasys, the strategic logic was clear. Despite controlling the high-end professional FDM market with systems costing $30,000-$200,000, Stratasys had no presence in the rapidly growing desktop segment where MakerBot dominated. The acquisition provided immediate access to MakerBot’s brand recognition, distribution channels, customer base, and importantly, Thingiverse, the largest repository of printable designs. Stratasys could now offer solutions across all price points from $2,000 desktop printers to $200,000 industrial systems.

MakerBot’s founders—particularly Bre Pettis who would continue leading the company under Stratasys ownership—faced intense criticism from the open-source community. Critics argued that MakerBot had built its business using open-source RepRap designs, benefited from community contributions and enthusiasm, then abandoned those principles once profitable exit opportunities arose. The controversy intensified when MakerBot closed source remaining design elements following the acquisition and began requiring users to accept terms of service that granted MakerBot certain rights over designs uploaded to Thingiverse.

Supporters countered that MakerBot had substantially improved upon RepRap designs, invested heavily in user experience and reliability improvements, and that its commercial success validated 3D printing to mainstream audiences in ways pure open-source projects couldn’t achieve. They also noted that open-source licenses like GPL don’t prevent commercial use or acquisition, and that MakerBot’s founders had every right to seek financial returns on their investment and work.

The debate reflected fundamental tensions in the open-source hardware movement: how to balance commercial sustainability with open principles, whether building businesses on open foundations creates obligations to maintain openness, and whether commercial success and democratic access can coexist. These questions would remain unresolved, but the community response was decisive: many former MakerBot enthusiasts shifted allegiance to truly open alternatives like Ultimaker and Prusa Research, which maintained open-source commitments while achieving commercial success.

The Great Kickstarter Boom and Bust (2012-2014)

Kickstarter and Indiegogo became launching pads for dozens of 3D printer startups between 2012 and 2014, each promising revolutionary improvements: faster speeds, better resolution, lower costs, or novel technologies. Some campaigns succeeded spectacularly, raising millions and eventually delivering functional products. Many others became cautionary tales of overambitious promises, underestimated development challenges, and outright fraud.

The typical pattern: an enthusiastic team with engineering backgrounds but limited manufacturing experience would create compelling renderings and functional prototypes, set a funding goal based on optimistic cost projections, and attract thousands of backers eager to get affordable 3D printers. Once funded, reality intruded. Prototypes couldn’t be manufactured at projected costs. Parts suppliers’ quoted prices didn’t scale as expected. Software proved harder to develop than anticipated. Quality control challenges emerged. Shipping logistics were complex. Customer support demands were overwhelming.

Some notable campaigns:

Peachy Printer (2013): Raised $651,000 CAD promising a $100 resin-based 3D printer using a novel scanning mechanism. The company struggled with technical challenges and internal disputes, ultimately delivering few printers to backers. In 2016, project creator Rylan Grayston publicly accused financial manager David Boe of embezzling funds to build a house. The project became a Kickstarter cautionary tale about inadequate oversight and financial controls.

Pirate3D Buccaneer (2013): Raised $1.4 million promising a $347 “printer for everyone” with beautiful industrial design and user-friendly software. Deliveries began slowly in 2014 with numerous quality issues: poor print quality, unreliable feeding, frustrating software. The company eventually filed for bankruptcy, though some backers did receive printers.

M3D Micro (2014): Raised $3.4 million for a compact $200 printer. Unlike many failed campaigns, M3D eventually delivered printers to most backers, though with significant delays and quality concerns. The company continued operating and iterating on subsequent models, demonstrating that execution challenges could be overcome with sufficient persistence.

LIX 3D Pen (2014): Raised $1.7 million for a 3D printing pen, then faced intellectual property disputes over whether the design infringed existing patents. While eventually delivering products, the campaign highlighted IP risks in the crowded 3D printing market.

The crowdfunding boom-and-bust cycle served several purposes. Successfully delivered projects genuinely advanced the technology and reduced costs. Failed projects educated backers about the risks of supporting unproven hardware startups. The collective experience established clearer understanding of what was realistically achievable versus marketing hype, tempering expectations for the next generation of ventures.

Patent Expirations Phase Two: SLA and SLS (2014)

If 2009’s FDM patent expiration democratized desktop 3D printing, then 2014’s expiration of key SLA and SLS patents promised to replicate that disruption for resin and powder-based technologies. Charles Hull’s foundational SLA patents from the mid-1980s entered public domain, as did several key SLS patents originally held by Carl Deckard and later acquired by 3D Systems through the DTM acquisition.

The market response differed somewhat from post-FDM dynamics. For SLA, numerous desktop resin printers appeared almost immediately, with Formlabs leading the charge. The company had actually launched via Kickstarter in September 2012 while key patents remained active, prompting a lawsuit from 3D Systems alleging infringement. The case settled in November 2014 with Formlabs paying royalties to 3D Systems and 3D Systems taking a small equity stake in Formlabs. Following patent expiration, legal obstacles removed, Formlabs and competitors like Anycubic, Elegoo, and Photon flourished.

Desktop SLA printers offered substantial advantages over FDM for certain applications: smoother surface finishes, finer detail resolution (typical layer heights of 25-50 microns versus 100-300 microns for FDM), and support for transparent or highly detailed parts. However, they also presented disadvantages: messy liquid resin handling, toxic photoinitiator chemicals requiring ventilation, post-processing requirements including washing and UV curing, and generally smaller build volumes due to vat size constraints. These factors prevented SLA from replacing FDM but established it as a complementary technology.

SLS democratization proved more challenging. While patents expired, the technical complexity and cost of SLS systems remained substantial. Laser sintering required high-powered lasers (typically 30+ watts for polymers), precise temperature control throughout large powder beds, inert atmosphere processing for many materials, and sophisticated powder recycling systems. Numerous startups attempted to produce “affordable” SLS printers, but even stripped-down designs cost $5,000-15,000 compared to $300-3,000 for FDM or desktop SLA machines. Additionally, SLS powder materials cost significantly more than FDM filament or SLA resin—nylon powder cost $60-100 per kilogram versus $20-40 per kilogram for FDM filament.

Nevertheless, several companies including Formlabs (with its Fuse 1 SLS system introduced later), Sinterit, and Sintratec brought SLS capability to customers who couldn’t justify $200,000+ industrial systems. While these affordable SLS printers didn’t match industrial system performance—smaller build volumes, slower speeds, fewer material options—they opened SLS’s fundamental capabilities (functional parts, no support structures required, good mechanical properties) to small manufacturers, universities, and service bureaus.

Industrial Acceptance: Aerospace and Medical Production (2014-2015)

While media attention focused on desktop 3D printing and consumer applications, the most significant developments occurred in industrial production, particularly aerospace and medical sectors where additive manufacturing began transitioning from prototyping tool to production method.

GE Aviation’s public commitment to producing fuel nozzles for its LEAP engine using metal additive manufacturing represented a watershed moment. The LEAP engine, designed for the Boeing 737 MAX and Airbus A320neo families—among the bestselling commercial aircraft—would be produced in volumes exceeding 1,000 engines annually once production ramped up. Each engine would contain fuel nozzles produced using Selective Laser Melting (SLM) of cobalt-chrome alloy, consolidating 20 conventionally manufactured parts into a single printed component. The printed nozzle weighed 25% less than its conventional counterpart while exhibiting improved durability and reduced fuel consumption.

GE’s decision validated several key principles. First, that additive manufacturing could achieve the quality, repeatability, and certification requirements for flight-critical commercial aviation components. Second, that part consolidation—combining multiple pieces into one—could justify higher per-part costs through assembly elimination, inventory reduction, and performance improvements. Third, that production volumes of thousands rather than millions of units represented additive manufacturing’s economic sweet spot where tooling costs didn’t justify traditional approaches but volumes exceeded pure custom/prototype work.

The medical device industry, particularly orthopedic implant manufacturers, embraced metal additive manufacturing even more aggressively. Stryker, Zimmer Biomet, DePuy Synthes, and Smith & Nephew all launched 3D-printed implant product lines between 2013 and 2015. The economic case was compelling: patient-specific implants commanded premium pricing, additive manufacturing enabled customization at production scale, and porous lattice structures that conventional manufacturing couldn’t produce actually improved biological integration.

Dental applications proliferated. Beyond Renishaw’s cobalt-chrome frameworks, companies began printing titanium implant abutments, surgical guides, and eventually complete denture frameworks. The dental industry’s combination of high unit values, customization requirements, and regulatory frameworks familiar with novel manufacturing methods made it nearly ideal for additive manufacturing adoption.

The Hype Cycle Peak and Beginning of Disillusionment (2014-2015)

Gartner’s 2014 Hype Cycle for Emerging Technologies placed 3D printing squarely at the “Peak of Inflated Expectations,” suggesting the technology had received maximum visibility and enthusiasm but hadn’t yet delivered on the most extravagant promises. The assessment proved prescient.

Stock prices for 3D Systems and Stratasys, which had reached absurd heights in late 2013 and early 2014, collapsed through 2014-2015 as investors recognized that the industry wouldn’t achieve hyperscaling growth that valuations implied. 3D Systems, which had traded above $90 in late 2013, fell to $15 by late 2015. Stratasys declined from $130 to $35 over the same period. The corrections reflected not that 3D printing failed, but that expectations had been irrational.

Media coverage shifted from breathless enthusiasm to skeptical examination. Articles appeared titled “Whatever Happened to 3D Printing?” or “Why 3D Printers Aren’t in Every Home Yet.” Such pieces typically revealed misunderstanding of the technology’s actual value proposition—3D printing was never poised to replace mass manufacturing for commodity products—but they reflected growing recognition that the revolutionary rhetoric had exceeded reality.

Within the industry, a productive maturation occurred. Companies that had raised funding during the hype years but lacked viable business models failed, while companies with genuine technology advantages or addressing real customer needs survived and grew. Desktop printer manufacturers recognized that prosumer users—engineers, designers, educators, medical professionals—represented more sustainable markets than hypothetical mainstream consumers who didn’t actually need to manufacture objects at home.

Industrial additive manufacturing companies, largely insulated from consumer hype cycles, continued steady progress. EOS, SLM Solutions, Concept Laser (later acquired by GE), Renishaw, and others expanded production capacity to meet growing demand from aerospace, medical, automotive, and tooling customers. Their message remained consistent: additive manufacturing excelled for complex, low-to-medium volume, high-value applications where design freedom and customization justified premium costs.

Reflections on Phase 1: Foundations Laid (2000-2015)

The fifteen-year period from 2000 to 2015 transformed additive manufacturing from niche industrial process to mainstream technology with both industrial production applications and consumer awareness. Several key themes characterized this transformation:

Patent Expiration as Catalyst: The expiration of fundamental FDM, SLA, and SLS patents removed legal barriers to competition, triggering price collapses and innovation acceleration that no single company could have achieved under monopoly conditions. This validated arguments against strong patent protection in emerging technologies, though it also raised questions about how companies could justify development investment if competitors could freely copy innovations once patents expired.

Open Source as Innovation Engine: The RepRap Project demonstrated that distributed, collaborative development could achieve results impossible for individual companies. By freely sharing designs, the RepRap community created an innovation ecosystem where thousands of contributors each improved small aspects, collectively advancing the technology faster than any corporate R&D program. However, tensions between open-source ideals and commercial sustainability remained unresolved.

Hype Cycles and Reality: The gap between media narratives and technical/economic reality created boom-bust dynamics in public perception and investment. While hype attracted capital and talent that accelerated development, it also generated unrealistic expectations leading to disappointment when reality didn’t match promises. The industry would need to mature beyond hype-driven growth toward sustainable expansion based on genuine value delivery.

Industrial vs. Consumer Bifurcation: Two largely separate worlds emerged: industrial additive manufacturing for aerospace, medical, and automotive production, and desktop 3D printing for education, prototyping, and hobbyist applications. The technologies, materials, and business models for these markets differed substantially, yet media coverage often conflated them, suggesting that desktop printer capabilities would soon match industrial systems.

Material Science as Differentiator: As hardware capabilities commoditized, proprietary materials became increasingly important for maintaining competitive advantage. Companies with unique materials enabling previously impossible applications could command premium pricing and customer loyalty even as basic hardware margins compressed.

Application-Specific Validation: Rather than wholesale replacement of conventional manufacturing, additive manufacturing found economic viability in specific niches: patient-specific medical devices, complex aerospace components, tooling and fixtures, bridge production, spare parts on demand, and mass customization. Understanding where additive manufacturing excelled versus where conventional methods remained superior proved critical for realistic business cases.

The stage was now set for Phase 2 (2016-2026), where the technology would evolve from demonstration to production scale, from technical capability to economic viability, and from revolutionary promise to evolutionary integration into global manufacturing. Industrial acceptance would accelerate, materials would diversify dramatically, software would become increasingly sophisticated, and the original question—”What can we do with 3D printing?”—would transform into “Where does 3D printing provide genuine competitive advantage?”

2016-2017: Post-Hype Rationalization and Industrial Acceleration

The Dust Settles: Realistic Assessment Emerges (2016)

As 2016 began, the 3D printing industry found itself in an unfamiliar position: ignored by mainstream media that had hyped the technology mercilessly just two years earlier, yet experiencing genuine industrial growth invisible to casual observers. Gartner’s 2016 Hype Cycle placed 3D printing solidly in the “Trough of Disillusionment,” accurately reflecting public perception but missing the substantial progress occurring within manufacturing facilities worldwide.

Desktop 3D printer companies faced harsh market realities. Consumer demand, never particularly strong despite media predictions of “a 3D printer in every home,” essentially evaporated as mainstream buyers discovered they had no compelling reason to manufacture objects at home. The prosumer market—engineers, designers, educators, medical professionals—proved more sustainable but considerably smaller than venture capitalists had hoped. Companies that had raised millions during the 2013-2014 boom began failing. 3D Systems, which had acquired multiple companies during its acquisition spree, announced layoffs and restructuring as its consumer product strategy collapsed.

Yet beneath these surface troubles, industrial additive manufacturing was quietly maturing. GE Aviation’s LEAP engine fuel nozzle production ramped up, manufacturing thousands of parts monthly by late 2016. Arcam AB reported record orders from aerospace and medical customers. EOS GmbH expanded capacity to meet demand. These industrial players focused on customers with clear value propositions: aerospace companies seeking weight reduction, medical device manufacturers enabling patient-specific customization, and tooling applications where rapid turnaround justified higher costs.

The bifurcation was complete. Desktop 3D printing and industrial additive manufacturing had diverged into essentially separate industries with different customers, technologies, business models, and trajectories.

Carbon’s Breakthrough: CLIP Technology (2015-2016)

In March 2015, Carbon3D emerged from stealth mode with a TED talk that garnered over 2.5 million views. Carbon introduced Continuous Liquid Interface Production (CLIP), which CEO Joseph DeSimone claimed was 25-100 times faster than conventional stereolithography.

Traditional SLA systems built parts layer by layer with distinct pauses. CLIP eliminated the stop-start cycle by continuously pulling the part from a resin vat while projecting UV light through an oxygen-permeable window. The oxygen created a “dead zone” preventing resin from curing on the window surface, enabling continuous motion. The result: smooth parts without visible layer lines, produced in minutes rather than hours.

Beyond speed, CLIP offered material advantages. Carbon developed engineering-grade polymers with properties approaching injection-molded plastics—elastomers, rigid polyurethanes, cyanate esters, epoxies—far surpassing traditional SLA resins.

In August 2015, Carbon raised $100 million at over $1 billion valuation. Early wins included Adidas (Futurecraft 4D midsoles), Ford (custom tools), Riddell (helmet liners), and dental companies. The success validated that venture investment remained available for companies addressing production manufacturing rather than hobbyist markets.

Desktop Metal’s Metal Revolution Promise (2015-2017)

Desktop Metal, founded October 2015 by Ric Fulop and MIT researchers, aimed to democratize metal 3D printing. The company raised $14 million Series A (January 2016) and $45 million Series B (September 2016) led by Google Ventures, with BMW, GE, and Stratasys participating.

Desktop Metal’s strategy involved two systems. The Studio System ($49,900+) used bound metal deposition—extruding metal powder bound in polymer, then sintering. The Production System ($360,000) used binder jetting, claiming 100x speed and 20x lower material costs versus laser powder bed fusion.

Claims generated both excitement and skepticism. Bound metal approaches involved 15-20% shrinkage during sintering, potentially causing distortions, and sintered parts historically had inferior properties versus fully-melted parts. However, strategic investors including GE and BMW lent credibility after presumably conducting technical due diligence.

HP’s Multi Jet Fusion Entry (2016)

In May 2016, HP began commercial deliveries of its Multi Jet Fusion system after four years development. HP’s entry validated that major technology corporations viewed additive manufacturing as worth pursuing.

Multi Jet Fusion employed a novel approach: spreading nylon powder, selectively applying fusing and detailing agents using inkjet printheads, then using infrared lamps to selectively fuse treated areas. HP claimed 10x speed improvements versus SLS, better material efficiency, and spatial control over properties.

The MJF 4200 ($130,000-150,000) targeted production manufacturing. HP explicitly positioned it not for prototyping but for functional end-use parts. The company brought manufacturing scale, supply chain expertise, and financial resources specialized AM companies lacked.

2018-2019: Materials Revolution and Production Scale-Up

The Materials Inflection Point (2018)

By 2018, the industry recognized that materials—not hardware—represented the primary barrier preventing broader production adoption. Standard FDM materials (PLA, ABS, nylon) served prototyping but lacked injection-molding-grade properties: high strength, temperature resistance, chemical resistance, dimensional stability.

BASF Forward AM: January 2018, BASF established Forward AM as a dedicated business unit, bringing €60+ billion resources and polymer expertise. The company committed to producing materials compatible with multiple printer manufacturers, recognizing vendor lock-in hindered adoption.

Arkema-PEKK: Arkema developed Kepstan PEKK for high-temperature applications (250°C+ continuous use), extreme chemical resistance, and mechanical properties exceeding many metals. Material costs of $500-800/kg restricted adoption to aerospace and high-value applications.

Evonik-PA12: Evonik, dominant PA12 supplier, announced capacity expansion and specialized variants: glass-bead-filled, aluminum-filled, and flame-retardant PA12.

Composite Materials: Markforged pioneered continuous fiber reinforcement for FDM. Short fiber reinforcement (chopped carbon, glass, Kevlar fibers mixed throughout polymers) offered more design flexibility but less dramatic property improvements.

Metal Alloys Expansion: Copper alloys (thermal/electrical), additional aluminum alloys (aerospace 6061, 7075), expanded tool steels (conformal cooling channels).

The materials expansion reflected industry recognition that materials innovation, not hardware innovation, would unlock production applications.

Formlabs’ Form 3 and LFS Technology (2019)

April 2019, Formlabs announced Form 3 using “Low Force Stereolithography” (LFS). The innovation addressed separation forces between each layer and the vat window. LFS used a flexible film with sliding peel motion, reducing separation forces by 90% versus rigid windows. Lower forces enabled larger parts, more reliability, and faster speeds.

Form 3 ($3,500) represented Formlabs’ push toward professional applications. The company expanded materials to engineering resins: tough, flexible, high-temperature, castable, and biocompatible resins.

By 2019, Formlabs had achieved remarkable success for a 2012 Kickstarter campaign. $85 million Series D (November 2018) at $1+ billion valuation, 50,000+ printers sold, $100+ million annual revenue. This validated desktop SLA for professional applications and building complete ecosystems creating competitive advantages.

Stratasys-GE Partnership (2019)

June 2019, Stratasys and GE Additive announced partnership to develop large-scale systems for aerospace, with Stratasys providing FDM expertise and GE providing aerospace understanding and purchase commitments.

Initially focused on printing structures exceeding two meters using ULTEM 9085 and Antero. GE identified applications including nacelle components, cabin brackets, and interior parts. Challenges included warping, heated chambers for cubic-meter volumes, multi-day print times, and aerospace certification.

Significance lay in signaling aerospace commitment to qualifying large-format polymer AM for production, with GE providing purchase assurance.

2020-2021: Pandemic Disruption and Manufacturing Resilience

COVID-19 Response (2020)

COVID-19 thrust additive manufacturing into critical pandemic response roles: ventilator shortages, PPE (face shields, respirator masks), test swabs, and broken supply chains.

Face Shields: Within days, designers shared 3D printable designs. Prusa Research’s design: printed headband in <2 hours with transparent sheet protector. Prusa produced 140,000+ shields for Czech facilities. Thousands of individuals organized through online communities. However, quality varied enormously, regulatory uncertainty emerged, and professional manufacturers eventually filled needs.

Ventilator Components: Isinnova reverse-engineered valves when official parts unavailable. Media coverage highlighted supply chain response potential. However, complete ventilators required far more than plastic parts—sensors, electronics, software, regulators—making 3D-printed ventilators technically possible but clinically inferior and potentially dangerous.

Testing Swabs: Most successful application. April 2020, Northwell Health partnered with Formlabs for nasopharyngeal swabs. Using surgical guide resin (biocompatible, sterilizable), received FDA emergency authorization within weeks. Formlabs, Carbon, HP, and others produced millions when conventional supply couldn’t meet demand.

Pandemic demonstrated strengths (rapid iteration, distributed production, zero tooling, geometric freedom) and limitations (scalability, quality consistency, regulatory uncertainty, coordination difficulty).

Desktop Metal SPAC (2020)

August 2020, Desktop Metal announced SPAC merger with Trine Acquisition valuing Desktop Metal at $2.5 billion, closing December 2020 with $575 million capital. Largest public market event since 3D Systems/Stratasys went public decades earlier.

$2.5 billion valuation despite only $12.6 million 2019 revenue reflected investor enthusiasm for metal AM production potential rather than current performance. Desktop Metal projected $1+ billion annual revenue within five years.

Skeptics questioned whether Desktop Metal could deliver. Binder jetting faced shrinkage, property inconsistencies, and surface finish challenges. Established competitors announced competing systems. Aerospace/automotive qualification required years.

Nevertheless, validated substantial capital availability for production-scale manufacturing rather than prototyping markets, and SPAC structure as viable public market path.

3D Systems Strategic Reset (2020)

May 2020, Dr. Jeffrey Graves became 3D Systems CEO (fourth in five years). Graves implemented strategic reset focusing on production applications rather than prototyping, healthcare/industrial rather than consumer, and efficiency rather than expansion.

Company divested non-core businesses, reduced expenses ~20%, focused R&D on production-grade materials and solutions. Launched Figure 4 production SLA systems (dental, medical, industrial), regenerative medicine platform, surgical guides/anatomical models.

Reset reflected industry maturation: focused execution on production applications with clear value propositions versus scattershot strategies.

2022-2023: Metal AM Critical Mass and AI Integration

Boeing 787 Titanium Parts (2022)

March 2022, Boeing announced titanium DMLS structural parts entered 787 production—first metal AM for primary commercial aviation load-bearing structures. Five years development, testing, certification following 2017 announcement.

Structural brackets/fittings (1.5-3 kg each) produced by Spirit AeroSystems and Premium AEROTEC using Ti6Al4V. Cost savings $2,000-4,000/bracket, totaling hundreds of millions lifecycle savings. Beyond per-part costs: topology optimization reduced weight 25-40%, integrated features eliminated operations, zero tooling compressed supply chains.

FAA certification required extensive material characterization (tensile, fatigue, fracture toughness across orientations), non-destructive testing, process qualification, statistical distribution proof. Reportedly $40-60 million over five years, but created templates accelerating future certifications to 2-3 years.

NASA Deep Space Habitat (2022)

August 2022, NASA awarded ICON contract for space-based construction potentially using lunar regolith. While speculative, NASA‘s terrestrial programs achieved concrete progress. Marshall Space Flight Center operated one of world’s largest metal AM facilities, testing rocket engine combustion chambers, turbopump housings, nozzles—some accumulating hundreds of firing cycles.

NASA’s aggressive adoption reflected space economics: tens/hundreds production volumes making tooling unjustifiable, complex internal geometries impossible conventionally, weight savings directly translating to payload capacity.

Validated technology for commercial space companies. SpaceX, Blue Origin, Rocket Lab, Relativity Space integrated metal AM components, with Relativity pursuing entire rockets via large-format metal/polymer AM.

Generative Design Integration (2022-2023)

AI and generative design algorithm integration accelerated 2022-2023: AI tools becoming accessible, sufficient AM build data for training, industry recognizing design optimization justified AM cost premiums.

Generative design—algorithmic exploration within constraints—existed since 1990s but remained computationally expensive. AM removed geometric constraints enabling designers to specify objectives (minimize weight, maximize stiffness) and constraints (mounting interfaces, build volume, materials), then algorithms explored thousands of designs selecting optimal solutions.

Key platforms:

- nTopology: Lattice structures and cellular materials for aerospace brackets, heat exchangers, impact absorption

- Autodesk Fusion 360: Integrated generative design into CAD, exploring hundreds of variations identifying solutions 30-50% lighter

- Altair OptiStruct: Structural optimization for automotive/aerospace

Impact extended beyond specific software. Generative design changed engineering approach: from “how to manufacture existing design via AM?” to “what design would be optimal if manufacturing via AM?” This mindset shift—designing for AM’s capabilities—unlocked economic value justifying cost premiums.

Material Partnerships (2023)

Throughout 2023, chemical companies announced partnerships expanding material ecosystems, reflecting maturation from hardware-centric to materials-focused business models.

BASF announced partnerships with HP, EOS, others qualifying BASF materials on multiple platforms. Open approach—materials compatible with multiple brands—contrasted with closed ecosystems, recognizing vendor lock-in discouraged investments.

Evonik announced capacity expansion tripling PA12 production by 2024 (~€400 million investment). Introduced PA 613, bio-based polyamide from castor oil addressing sustainability demands.

Chemical companies’ hundreds-of-millions investments signaled viewing AM as strategic growth market. Validated predictions that materials would ultimately exceed hardware sales.

2024-2025: Production Maturity and Economic Reality

Break-Even Analysis (2024)

By 2024, sufficient experience established realistic understanding where AM provided genuine economic advantages. Comprehensive studies analyzed total cost of ownership across scenarios.

Consensus findings:

Polymer AM vs. Injection Molding:

- Below 500-1,000 units: AM typically more economical (zero tooling)

- 1,000-10,000 units: Contested territory depending on complexity/design freedom value

- Above 10,000 units: Injection molding nearly always cheaper

- Exception: Mass customization where each part differs (dental aligners, hearing aids, medical devices)

Metal AM vs. Machining:

- Below 100 units: AM competitive for complex geometries

- 100-500 units: AM often cheaper for high buy-to-fly ratios (significant material waste)

- Above 500 units: Machining typically cheaper unless AM enables design optimization

- Sweet spot: Aerospace components with complex internal features, 50-500 units annually

Metal AM vs. Casting:

- Below 1,000 units: AM advantageous (eliminates $50K-500K+ casting tooling)

- 1,000-5,000 units: Depends on complexity and post-processing

- Above 5,000 units: Casting almost always cheaper

- Exception: Parts leveraging AM geometric freedom (topology optimization, integrated features, conformal cooling)

Studies highlighted non-economic factors: reduced lead times, supply chain resilience, rapid design iteration, reduced inventory costs.

Automotive Production Applications (2024-2025)

Despite decade-old predictions, production applications remained concentrated: high-performance vehicles, limited editions, tooling/fixtures, spare parts.

Porsche: Expanded beyond GT2 RS pistons to titanium suspension wishbones (40% lighter), Sport Classic seat shells with tuned lattice structures. Remained optional premium upgrades, reflecting AM cost position.

BMW Tooling: Operated 300+ polymer/metal AM systems, primarily for tooling/fixtures/manufacturing aids rather than production parts. Typical plant consumed 50,000+ custom tools. AM enabled on-demand production versus inventories, rapid iteration. Economics compelling: $200 fixture in three days versus $2,000 machined fixture in six weeks.

GM Spare Parts: Announced on-demand program for classic vehicles (15+ years out of production). Addressed persistent problem: ceased manufacturing parts, forcing junkyard searches or custom fabrication. Created profitable heritage revenue stream while enhancing brand loyalty.

Why Mass Production Remained Limited: Fundamental economics unfavorable. Stamped body panel $15-30 at 100,000+ volumes. Equivalent AM panel $500-2,000—30-100x differential no design optimization could overcome.

Pattern validated broader principles: production succeeded where AM capabilities (geometric freedom, customization, rapid iteration, tooling elimination, supply chain compression) justified cost premiums, not where AM competed directly with optimized mass production.

Bioprinting Clinical Translation (2024-2025)

Despite 2010s media predictions of printed organs “within 5-10 years,” reality remained far more modest while achieving meaningful progress.

What Actually Worked:

- Skin substitutes: FDA-cleared bioprinted skin for burns/wounds, though with mechanical/vascularization limitations

- Bone scaffolds: Patient-specific bone scaffolds (bioceramics/biodegradable polymers) with stem cells demonstrated clinical success

- Cartilage implants: Small cartilage structures for nose/ear reconstruction showed promise in trials

- Tissue models: Bioprinted liver/heart/kidney models achieved commercial success for drug screening

What Remained Difficult:

- Vascularization: Blood vessel networks supplying thick tissues (>1-2mm) remained fundamental challenge

- Cell source scalability: Producing billions of cells for organ-scale structures remained expensive/time-consuming

- Functional integration: Electrical integration (cardiac/neural), mechanical properties, immune compatibility extended beyond printing

- Regulatory uncertainty: No clear framework for evaluating bioprinted organs

Sobering reality: truly functional, transplantable bioprinted organs remained decades away. Technology served valuable purposes (drug testing, tissue engineering research, regenerative medicine) but wouldn’t address transplant shortages soon.

Industrial Consolidation (2024-2025)

Industry experienced substantial consolidation as larger companies acquired specialists and partnerships proliferated.

Stratasys-Desktop Metal Attempted Merger (2023-2024): May 2023 announcement valuing combined company ~$1.8 billion. Rationale: Stratasys polymer leadership plus Desktop Metal metal technology. However, 3D Systems launched hostile counter-bid, activist investors challenged both, antitrust concerns emerged. Both deals collapsed September 2024.

Nano Dimension Acquisition Spree (2021-2024): Israeli electronics AM company aggressively acquired DeepCube (AI), Admatec (ceramic AM), NanoFabrica (micro-precision AM), attempted Stratasys (blocked). Strategy reflected vision of comprehensive digital manufacturing platform.

3D Systems Focused Acquisitions (2022-2024): Following reset, made targeted acquisitions: Allevi (bioprinting), Kumovis (medical polymers), Oqton (manufacturing software). Aimed to build complete solutions for specific verticals rather than broad diversification.

Consolidation reflected industry maturation: early markets support numerous specialists, mature markets demand complete solutions, triggering consolidation to build comprehensive offerings.

2026: The State of Additive Manufacturing

Current Market Reality (January 2026)

Global additive manufacturing industry: ~$28 billion annual revenue across hardware, materials, software, services. While substantial, represented more modest growth than early 2010s hyperbolic predictions of $100+ billion by 2025. However, achieved something more valuable: sustainable economics in production applications across multiple sectors.

Market Segmentation:

- Industrial polymer: $7.2B (26%)

- Industrial metal: $8.4B (30%)

- Desktop/professional: $3.1B (11%)

- Materials: $5.6B (20%)

- Services/software: $3.7B (13%)

Geographic Distribution:

- North America: $10.9B (39%)

- Europe: $8.7B (31%)

- Asia-Pacific: $7.3B (26%)

- Rest of World: $1.1B (4%)

Application Breakdown:

- Aerospace/Aviation: 28%

- Medical/Dental: 22%

- Automotive: 15%

- Industrial equipment: 12%

- Consumer products: 8%

- Electronics: 6%

- Other: 9%

Aerospace and medical dominance (50% combined) reflected where AM value proposition was clearest: low-to-medium volume production of complex, high-value parts where customization, weight reduction, or geometric complexity justified cost premiums.

Technology State of the Art (2026)

Polymer AM:

- Build speeds: 10-15x faster than 2015

- Materials: 200+ qualified engineering thermoplastics including PEEK, PEKK, Ultem, PA variants

- Typical costs: $200-$800/kg engineering, $20-$60/kg commodity

- System prices: $3K-$15K desktop, $40K-$150K professional, $200K-$800K industrial

Metal AM:

- Build rates: 100-200 cc/hour powder bed fusion, 500-2,000 cc/hour binder jetting

- Materials: 40+ qualified alloys (titanium, aluminum, Inconel, tool steels, copper, cobalt-chrome)

- Typical costs: $65/kg (stainless) to $200/kg (Inconel)

- System prices: $300K-$800K industrial powder bed fusion, $500K-$2M large-format

Emerging Technologies:

- Continuous fiber composites: Commercial systems (Markforged, Desktop Metal, 9T Labs)

- Volumetric printing: Nascent technology printing entire parts in seconds using holographic projection

- Multi-material systems: Platforms printing 2-7 materials simultaneously

- Large-format: Build volumes exceeding 1 cubic meter polymer, 0.5 cubic meters metal

What Finally Worked (2026)

Twenty-six years post-millennium, additive manufacturing found its place—not revolutionary replacement but evolutionary complement to conventional processes.

Economic Sweet Spots:

- Production volumes: 10-1,000 units annually (occasionally to 5,000)

- Part complexity: Designs leveraging geometric freedom (topology optimization, integrated features, internal channels)

- Customization: Patient-specific medical devices, limited editions, configured products

- Development phase: Rapid iteration before production tooling

- Spare parts: On-demand replacing inventory costs

Value Justification:

- Weight reduction worth fuel savings (aerospace)

- Customization enabling premium pricing (medical, luxury goods)

- Supply chain compression reducing inventory/lead time costs

- Part consolidation reducing assembly/failure points

- Design optimization improving performance beyond conventional capabilities

Organizational Requirements:

- Design expertise in design-for-additive-manufacturing (DFAM)

- Process engineering for qualification/production control

- Quality systems appropriate for criticality

- Supply chain integration for materials/post-processing/inspection

- Long-term commitment recognizing 2-5 year qualification efforts

What Still Doesn’t Work (2026)

Despite progress, numerous predicted applications remained impractical:

Consumer Products: “3D printer in every home” definitively failed. Desktop printer sales declined from 2018 peak. Why? Most people don’t want to manufacture objects; they want to use them. Time, effort, skill required to design/adapt models, print (hours to days), perform post-processing exceeded consumer patience. Buying finished products remained vastly more convenient.

Food Printing: Despite chocolate printers/pasta extruders demonstrations, 3D printed food remained novelty. Print times exceeded conventional cooking, textures were unappetizing, cleanup was complex.

Clothing/Textiles: While fashion designers created striking runway garments, wearable clothing remained dominated by conventional textiles. Printed clothing was stiff, uncomfortable, didn’t breathe, couldn’t match textile drape/flexibility. Niche applications: custom orthotics, prosthetic interfaces, protective equipment.

Electronics Production: Printed electronics remained largely limited to research. Creating functional circuits required printing multiple materials (conductors, semiconductors, insulators, dielectrics) with precise registration, followed by processing. Conventional electronics manufacturing’s cost, performance, reliability advantages were overwhelming.

Mass Production: Fundamental economics unchanged: AM couldn’t compete with optimized mass production (injection molding, stamping, casting, machining) for products in thousands to tens of thousands volumes. Most consumer products, automotive components, commodity goods continued using conventional manufacturing.

Looking Forward: Next Decade (2026-2036)